World Bank, East Asian and South American Economies

The World Bank group estimates that 670 million have been lifted out of extreme poverty between 1999 and 2010. According to estimates by 2015, in excess of 1 Billion people will have improved their living standards beyond the lowest levels.

With respect to overall poor in country populations, Latin America has fewer poor than does East and Southern Asia.

Attaining Middle Income status as a country on a per capita basis is highly desirable for many countries. Roughly 40% of the G77 are just below the Middle Income range and a few of the G20 are aspiring to be solidly in the Middle Income area.

Middle Income Trap is a term used to describe not just the level of development an emerging market is in relative to its beginnings, but the investment needs of the future to keep the market out of a middle income range.

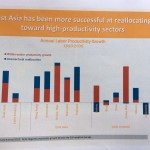

The World Bank has identified this range as being between $1,000 and $12,000 of gross national income per capita. The needs to be unstuck in this area are conversion to high productivity labor and large investments into infrastructure.

Education levels will be critical to helping Latin America out of the Middle Income trap. Latin America has its best universities and preparatory schools in the private sector. In East and Southern Asia the public school system is the primary source for higher education. A strong public school system is large determiner in the success at the low and middle income levels of a region. The larger populous has access to the best school systems. Latin America must invest in their public school systems.

Latin America has some lessons from its evolution in development for South Asia. Latin American navigated away from the Commodity export trap from the mid 1980s and parts of the 1990s to a diversified mix of exports. The East Asia Tigers have an outmoded dependence on exports, in excess of 40%.

“The world will be different after the Great Recession, the world will grow more slowly, will continue to change and the question at what rate, remains to be seen.”, said Santiago Levy, Vice President of the Inter American Development Bank.

“Latin America will not perform as well as it did in the previous decade and perform less well because it does not have the same conditions in those same international markets and tailwinds from the growth of China and Asia helping them through commodity prices will not be present.”, VP Santiago Levy continued. “The productivity growth differences between Latin America and East Asia are the of the most important to South America.”

“Good times are Bad times for economic reforms.”, professor Barry Eichengreen of University of California, Berkeley said.

Th Minister of the Philippines explained that her country is part of the global supply chain and that Manila would not be immune to possible future high interest rates, however, the Philippines is less susceptible than its neighbors.

Foreign Direct Investments are still a large part of the Philippine economy, but an increase in domestic consumption is in a greater degree contributing to the country’s economy.

The central bank governor of Malaysia was asked about Quantitative Easing and tapering.

“We must accept two things, QE is occurring because of a sustained recovery and that tapering is an inevitable part of all of our futures.”, Miss Zeti Akhatar Aziz said.

This comment prompted the moderator to ask whether the audience was more concerned the tapering of QE in the US or a slow down in China. By a nearly 100-0 vote, the predominantly latin and asian group thought that a Chinese slowdown was of greater worry.

Miss Aziz of Malaysia noted that a major factor in Asia’s success is the communication between the finance ministers and central bankers in the region. In fact, she said there was recent test to see how long it would take for all bankers to contact each other. Budgeted was 2 hours. In less than 45 minutes all banks and ministers had heard from each other.

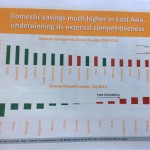

The savings rates in East Asia versus South America is a key area of needed improvement for Latin America.

The goal of most of Latin America is to increase growth while also increasing savings. Mechanisms for Latin American banks should be bolstered and savings incentives could drive increases in M3 and MZM, money with zero maturity in South America.

– By Julien David – Reporting from the World Bank in Washington DC

Comments are closed.